Following the recent Budget, the Government is set to impose limits on PRSA contributions. This could impact your ability to make significant lump sum payments to your pension. Learn more about the changes and how they might affect your financial plans.

What’s changing?

Two years ago, the Government lifted restrictions on the amount that an employer could pay into a pension for a member of staff or a director. In practice there was no effective limit on the amount that could be paid in.

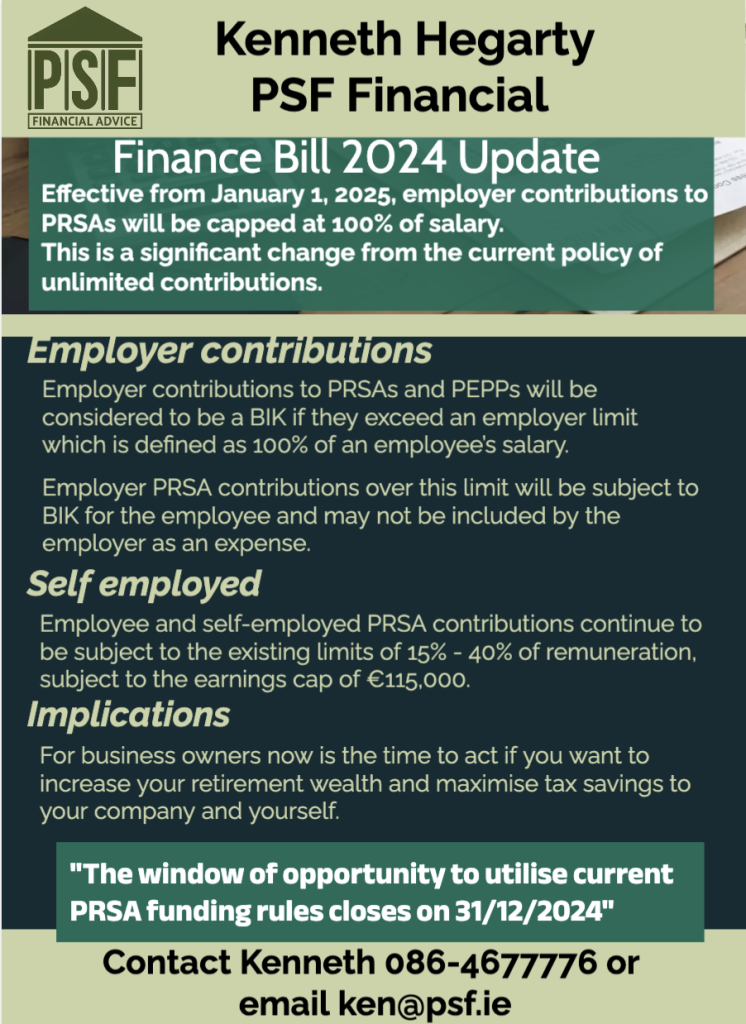

However, the Finance Bill 2025, published on Thursday, has placed a limit on employer contributions from a BIK-exemption perspective to 100 per cent of income drawn from the business in the same year.

For example, if the employer contributes €70,000 to a PRSA for someone earning €50,000, the additional €20,000 will be taxed as part of the employee’s income

Now, they are moving to restrict the amount an employer can pay in to 100% of the person’s salary. On top of that, the individual could still make their age-related personal contribution.

Who is affected by changes to PRSA contribution limits?

This change will impact anyone who is looking to put large lump sums into a pension structure.

There are several key groups of people:

1)Those who are drawing low salaries and prioritising pension savings with the earnings from their business.

2) Self-employed people who plan to make a large top-up to their pension during a year of particularly strong trading.

3)Those who have multiple employments and draw their main income from one source, and use another mainly for pension funding.

When will the change occur?

The legislation to govern this change is in the Finance Bill, which is currently making its way through the Oireachtas. It seems likely to take effect from 1 January 2025.

But that’s not guaranteed. A general election seems imminent, and the commencement order for this change could be published with little or no warning.

What should you do?

There are several options to minimise the effect of this change on your pension plans.

Firstly, there is still time to make a lump sum top-up. Although it’s likely to last until 31 December 2024, the restrictions could come in before that. So if you are planning a material contribution to a PRSA in 2024, the sooner you do it, the better.

Secondly, you may wish to accelerate future pension contributions. That could involve raising cash within your company in order to fund a lump sum contribution now. If that pushed the company into a pre-tax loss in the current year, those losses could be set against future profits to reduce corporation tax.

Thirdly, once the changes are made, you could increase your salary, which in turn will increase the scope for funding a PRSA – both through an employer contribution and via a personal contribution.

Lastly, employer-backed pensions will continue to have generous allowances for adding lump sums to your pension, for example to catch up for years of service where you didn’t pay in.

Get in touch if you would like to discuss how these changes affect your financial plans. We can help you make sense of the changes, quantify the impact on you, and devise an action plan to address it.

Contact me to discuss your options