What is an Executive Pension?

An Executive Pension is a pension set up by the Ltd company for the benefit of the Directors/Employees of the company. The pension is set up under a trust and typically the employer will act as the trustee.

With an Executive Pension both employees and employers can make contributions. The ultimate value of your pension plan will depend on the contributions that have been made over the years and the investment return the funds have achieved in your Executive Pension.

What is the benefit of an Executive Pension Plan over a Personal Pension?

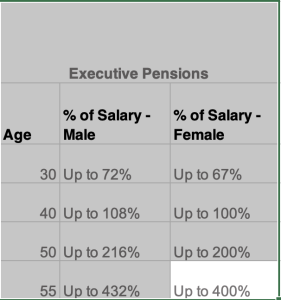

1. The limits on contributions to an Executive Pension are significantly greater than a Personal Pension. As you can see from the table below

2. The tax relief is also more attractive. The maximum rate of relief on a Personal Pension contribution is 40%. If you contribute to an Executive Pension it is effectively saving you tax at 52%.

3. You can also claim the benefit of your pension from the age of 50 vs age 60 in a Personal Pension.

What are a Self-Administered Pension schemes

This is a Revenue Approved scheme set up by the company for a director. It differs from traditional pension plans provided by insurance companies as it is self-administered, which allows you to control your contributions and investments. You would need to appoint an independent trustee, as approved by the Revenue Commissioners, and you are a co-trustee.

What are the benefits of a Small Self-Administered Pension?

The benefits are that the pension is flexible and allows you a high element of control. You have a large selection of investment options such as direct properties, shares and bonds to suit your risk profile. Your pension can also currently borrow, remember you work with your advisors, investment managers and accountant to choose the right investment strategy. You have complete investment control of your pension. You also have large scope to make contributions into the scheme.

When would I chose this over an Executive Pension?

You would usually only choose to invest in a Self-Administered Pension Scheme if you wanted to invest in assets which are not available in an Executive Pension e.g. Direct Property Purchase shares in unlisted companies etc. as the cost of set up and maintenance can be high in comparison to an Executive Pension.

How much can I contribute to my Pension through my Limited company?

It depends on several factors. Ultimately as an individual making personal contributions you are limited to the normal revenue rules which relate to age and appropriate % of salary e.g. if you are in your 40’s its 25% of your salary. When it comes to the company making the contribution on your behalf, as is the case with an Executive Pension, then there are a range of factors in determining how much can be contributed.

- Age

- Gender

- Marital Status

- Chosen Retirement Age

- Salary

- Previous Pensions

- Years of service with the current employer

Which can lead to contribution factors such as in the table below which are obviously more favourable than using the Personal rates.

Talk to Kenneth to learn more about PRSA. We can guide you through a variety of investment solutions tailored to your preferred level of risk.

Contact Kenneth at PSF to explore your options