Lanesborough Street,

Roscommon Town,

Roscommon,

F42 F597

A Personal Pension is a privately owned pension, held in your name. Unlike a company pension plan where your employer may make contributions to your pension, only you can make contributions to a personal pension.

To take out a Personal Pension you will have to be earning an income which is taxable in the current tax year.

Product features

- Choice – there is a wide range of investment options, designed to meet your needs.

- Flexibility – You can increase your contributions, or make a one-off contribution, at any stage.

Who is this product for?

A Personal Pension Plan (PPP) is suitable for anyone saving for their retirement. It is mainly suited to those who are self-employed, or whose employer does not offer a pension scheme.

Most personal pensions policies are insurance policies. Unlike most insurance policies, you can get tax relief on pension contributions.

If you have a personal pension, you do not have to always remain in the same pension fund. You can transfer funds accumulated with one insurer to another fund with another insurer. There may be costs involved in doing this.

How much will it cost?

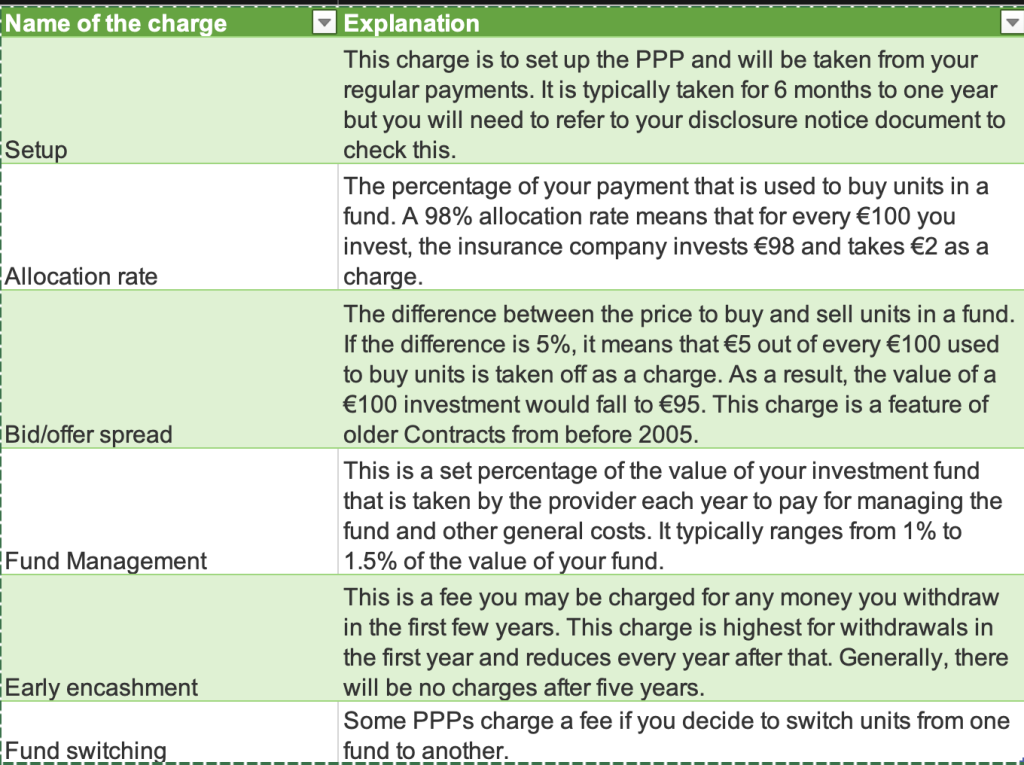

All PPPs will have various charges and they will be set out in your Disclosure Notice document. The following are some of the charges that you may have to pay at the start and during the life of your PPP.

What happens to the money you pay into your PPP?

The insurance company will invest your money in a fund or a number of funds that they feel will perform best to make as much money as possible for you over the life of the PPP. The diagram below shows the type of funds that an insurance company could invest in on your behalf, for example, buying shares in different companies, buying government bonds and investing in property. The insurance company will also take the money for various charges from your contributions.

Contributions

How much should I contribute? It’s one of the most common questions people ask. While there’s no minimum amount, the maximum amount you can contribute depends on your age.

Manageable

With a personal pension plan, you control how much you contribute towards your pension

When you retire

On retirement you can take a tax-free lump sum of 25% of your fund, up to a maximum of €200,000.

The remainder of your fund can then be invested in an annuity or Approved Retirement Fund

Contact Kenneth at PSF to explore your options